Metro Vancouver Real Estate Market Insights: Your Comprehensive Real Estate Update with Jersey Li ☀️

It's always sunny with me ☀️ This is your trusted REALTOR®, Jersey Li 😄!

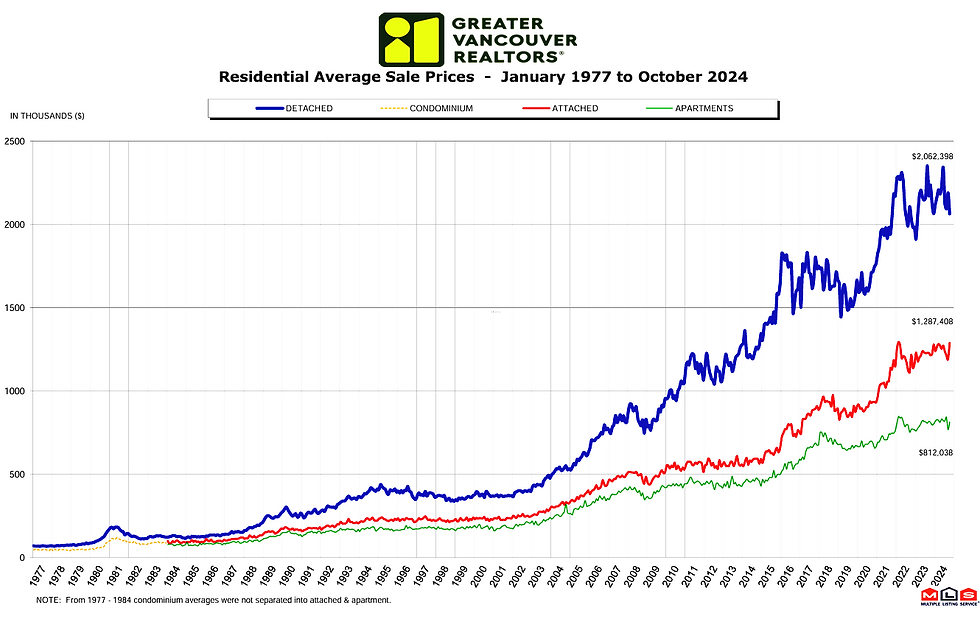

Welcome back to another edition of the Stats Centre Report! I’m Jersey Li, your trusted REALTOR®, and I’m here to keep you informed about the latest trends in Greater Vancouver’s real estate market. As we wrap up 2024, the market is showing exciting signs of recovery, especially after the recent Bank of Canada rate cut. Whether you’re buying, selling, or renting, there’s plenty of opportunity right now. Let’s dive into the Metro Vancouver Real Estate Market Insights and what they mean for you!

Jersey's Market Feedback

Buyers Are Back! At least temporarily!

On October 23rd, the Bank of Canada announced a 0.5% reduction in the policy rate. This significant cut has already ignited buyer interest, with the real estate market picking up momentum after a slow year. If you’ve been waiting on the sidelines, the clock is ticking to take advantage of lower mortgage rates before the market heats up even more.

According to the Greater Vancouver REALTORS® (GVR), home sales surged by 31.9% from the 1,996 sales recorded in October 2023, marking a robust comeback after months of subdued activity. With four consecutive rate cuts, buyers are jumping back into the market, driving demand and pushing prices upward.

Expert Insight: “The recent uptick in sales suggests that buyers are finally responding to lower borrowing costs after waiting on the sidelines,” says Andrew Lis, GVR’s Director of Economics.

Jersey's Market Prediction

What’s Next?

Short-Term (1-2 Years)

Interest Rates: Following multiple rate cuts, expect a continued buyer resurgence, especially in the condo and townhome segments. The window for historically low borrowing costs may not last, as economic recovery could prompt the Bank of Canada to stabilize rates by mid-2025.

Seller’s Market: As inventory tightens and demand grows, expect a shift towards a seller’s market in early 2025, particularly for apartments and townhouses.

Mid-Term (3-5 Years)

New Construction Boom: Anticipate a surge in new construction projects, particularly in transit-oriented developments around the SkyTrain lines in Burnaby, Coquitlam, and Surrey. This influx of new inventory may ease some of the upward pressure on prices.

Rental Market Growth: With immigration policies favouring skilled workers expect a steady influx of new residents, which will continue to drive up rental demand. Investors should look to capitalize on high-yield opportunities in emerging neighbourhoods.

Long-Term (5-10 Years)

Demographic Shifts: As Baby Boomers downsize, expect an increased supply of detached homes to hit the market, which could moderate price growth in this segment. However, Greater Vancouver’s appeal will sustain long-term demand, especially for condos and townhomes.

Sustainable Living: Given rising climate change concerns, sustainable and energy-efficient homes will command a premium. Developers are increasingly incorporating eco-friendly features, which will become a key selling point for future buyers.

Prediction Summary

The Greater Vancouver real estate market is poised for steady growth, with potential fluctuations based on economic policies and global trends. Whether you’re planning to buy, sell, or invest, staying ahead of these trends will ensure you make the most of market opportunities.

Sales Stats:

The notable increase in sales volume, especially for attached homes and apartments, highlights a renewed confidence among buyers. The detached home market also shows signs of stability, with prices holding steady. However, apartments have experienced a slight dip in benchmark prices, making it an opportune time for first-time buyers and investors to enter the market before prices rebound.

To gain a deeper understanding of the real estate market in Metro Vancouver, I recommend clicking here to access the comprehensive Stats Centre Report. Inside, you will find data-driven insights that are carefully curated to provide you with the knowledge necessary to make informed real estate decisions in today’s dynamic market.

Market Tip: With apartments leaning toward a seller’s market due to a higher sales-to-active listings ratio, consider acting quickly if you want to invest in condos

Rentals Stats

As the demand for rentals remains strong across the Greater Vancouver Area, renters are navigating a competitive landscape. The latest rental data shows that rates have risen for 1 and 2-bedroom units in several municipalities, reflecting the broader trend of increasing demand for smaller living spaces due to affordability concerns. Full report here.

Burnaby: One-bedroom units are averaging $2,426, while two-bedroom units have seen a slight drop to $2,964. Three-bedrooms are holding at $3,612.

Surrey: The most budget-friendly city on the list, with one-bedrooms at $1,964, offering a great option for those looking for more affordable living.

Vancouver: Prices continue to climb, with one-bedrooms at $2,564 and three-bedrooms reaching $3,879.

West Vancouver: The luxury rental market remains strong, with three-bedroom units averaging $4,340.

Rental Insight: As North Vancouver and West Vancouver lead in price increases, renters are considering suburban areas like Surrey and Langley for more affordable options without compromising on quality of life. If you’re thinking of renting in 2024, consider securing your lease now to lock in current rates before they climb further.

Key Takeaways for November 2024:

The Bank of Canada’s 0.5% rate cut has reinvigorated the market, driving a 31.9% increase in home sales year-over-year in October 2024.

Lower borrowing costs encourage more buyers to re-enter the market, particularly for attached homes and apartments.

Detached Homes: Benchmark price stable at $2,002,900 with sales up 25.5% YoY.

Attached Homes: Strong growth with sales up 40.7%, reflecting a shift in buyer preference.

Apartments: Slight price dip (-1.6% YoY), making condos an attractive entry point for first-time buyers.

Rental rates have increased across most municipalities, with Burnaby and North Vancouver seeing significant jumps.

Surrey remains the most affordable rental option, while Vancouver and West Vancouver continue to lead in pricing.

Short-Term: Expect a surge in buyer activity through early 2025 as interest rates remain low, with a shift towards a seller’s market for condos and townhouses.

Mid-Term: Anticipate a new construction boom near transit hubs and a strong rental market driven by ongoing immigration.

Long-Term: Sustainable, eco-friendly homes will attract premiums as climate concerns shape buyer preferences.

The current market dynamics present a unique opportunity for buyers, sellers, and investors to capitalize on favourable conditions.

Whether you’re entering the market for the first time or looking to expand your investment portfolio, now is an opportune time to act.

Personal Assistance

Your Real Estate Journey, Your Way 🤝

Whether buying your first home, looking to invest, or planning to sell, the real estate market is full of opportunities right now. With lower interest rates and a strong rental market, it’s an excellent time to move.

At the end of the day, real estate is not just about properties; it’s about people and the dreams they aspire to achieve. I’m here to guide you through every step of the journey with expertise, market knowledge, and a commitment to making your real estate experience as seamless as possible.

📲 Contact Me Today: Ready to explore the market? Reach out for a personalized consultation to discover your next home or investment property.

Thank you for tuning in to this month’s market update. Stay tuned for more insights, and feel free to ask any questions. Happy house hunting! 🏡

Let’s explore your real estate goals together and find a strategy that fits your unique needs. Remember, it’s always sunny with me! ☀️

Thank you for joining me on this Real Estate journey,

🏙 The 𝗔𝗽𝗮𝗿𝘁𝗺𝗲𝗻𝘁 𝗚𝘂𝘆

🙋🏻♂️ 𝗝𝗘𝗥𝗦𝗘𝗬 𝗟𝗜 Personal Real Estate Corporation

📧 Email: jersey@primeprec.com

📱 Phone: 778-991-0051

.png)

.png)

Comments